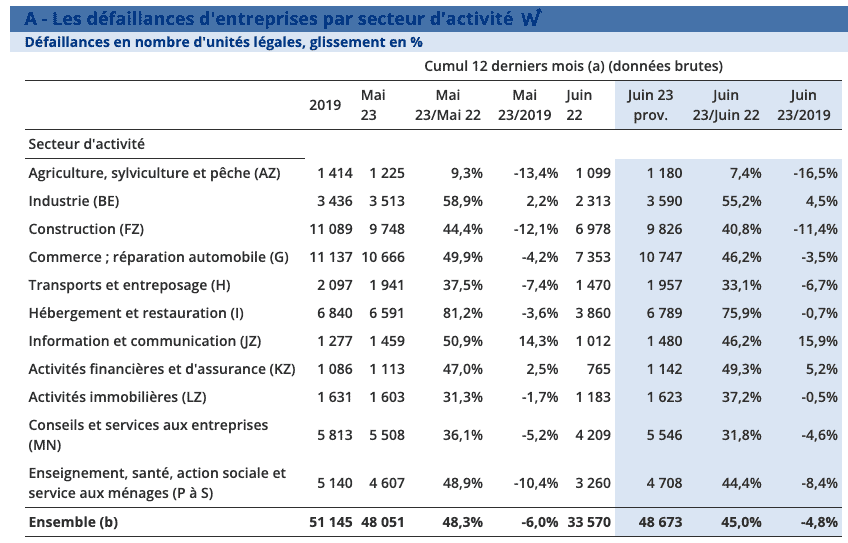

According to the monthly watch published by the Banque de France a few days ago, after rising levels of bankruptcies in the first quarter of 2023, the situation does not appear to be reversing for this second quarter. Although it remains below the pre-pandemic average level, a total of 48,673 failures occurred between July 2022 and June 2023, compared with 33,570 failures in the same period last year and the pre-average 59,342 failures. However, micro-enterprises, which make up the bulk of SMEs in France, are the only ones that haven’t reached 2019 levels. If we remove them from the calculation, the number of failures is actually higher than this period. before the crisis.

No sector or type of company is spared

according to the report, “The catch-up movement concerns all sectors of the economy and companies of all sizes”, However, its magnitude is markedly lower for micro enterprises and enterprises of uncertain size, which also brings down the overall average.

In fact, even though the number of failures of micro enterprises increased by 42.7% in one year (June 2023/June 2022), it is 7.9% less than in 2019. On the other hand, for other categories, the figures revealed are higher than in 2019. Thus, bankruptcies for very small companies are up 57% from their 2019 levels, 62.8% for small companies, 50.4% for medium-sized companies and 103.8% for medium-sized companies (ETIs) and large conglomerates.

When we look at the data by business sectors, we see that “mobile commerce and repair” is the sector with the highest number of business failures in June 2023 with 10,747 failures, as well as a significant increase in bankruptcies, which is almost equal to 50% in one year. This situation can be explained by record inflation levels, decline in domestic purchasing power and continued attraction of consumers towards e-commerce. Other sectors have registered an alarming increase in bankruptcies during the past year. This is especially the case for the “accommodation and catering” activity, with an increase of 75.9%, followed by “industry” (55.2%) and “financial and insurance activities” (49.3%).

Results that alarm and run the risk of dramatic consequences such as judicial liquidation and mass layoffs.

Banque de France wants to be sure

Banque de France has said in its report that it is necessary to pay attention to “The total number of failures in a one-year period is lower than the average recorded between 2010 and 2019, before the COVID-19 pandemic”, Modifications to bankruptcy status characterization and declaration dates, as well as temporary measures such as public measures of cash assistance, have helped avoid a large number of business failures during the health crisis. This is even higher in the case of catering and accommodation, whose default levels were particularly low during the pandemic due to state-allocated aid.